Cost of Assisted Living in Kolkata (2025): Full Monthly Fee Breakdown & Hidden Charges

I. Introduction

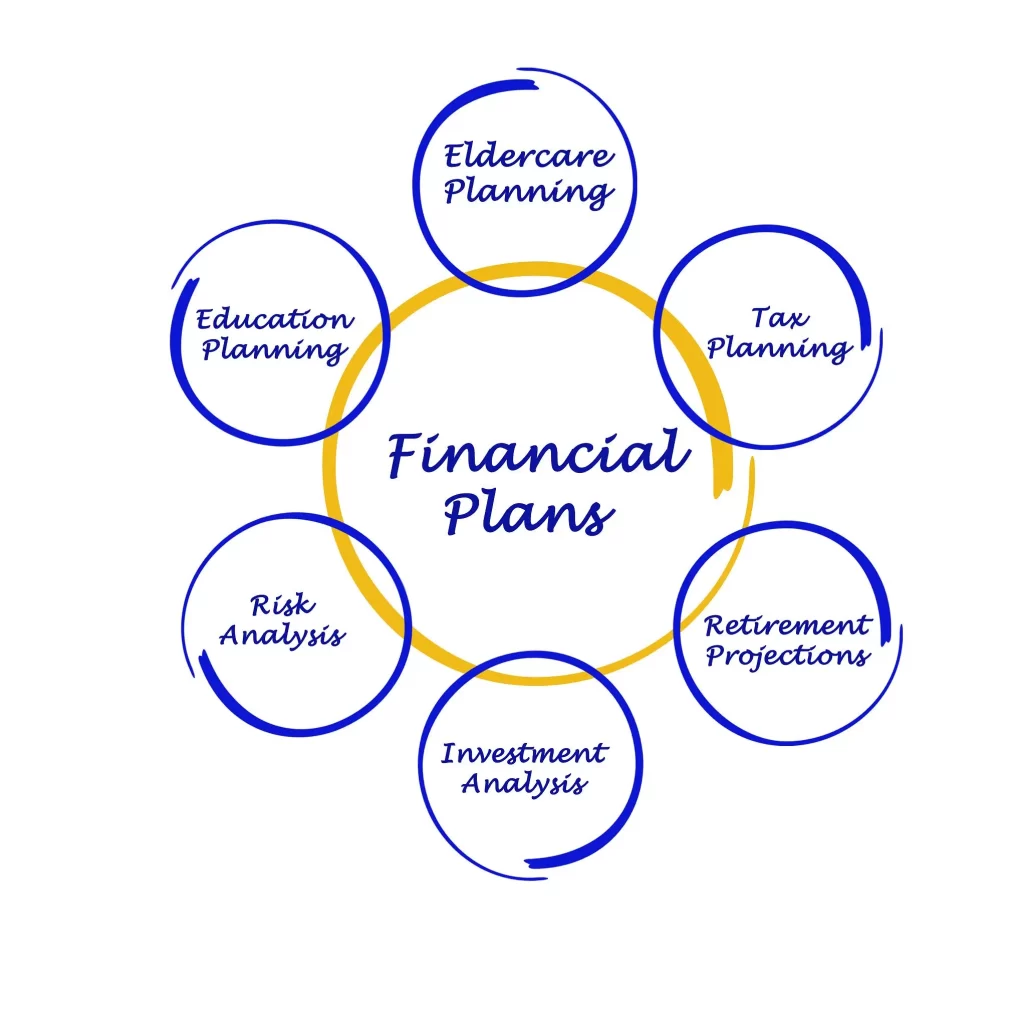

The decision to move to a retirement community or senior living facility in Kolkata is often filled with emotional considerations. Yet, the most crucial step—and the one most frequently overlooked—is the financial planning for senior living in Kolkata (2025). With rising inflation and increasing demand for premium care, securing your financial health is paramount to ensuring a dignified and comfortable retirement.

This comprehensive guide, updated for the 2025 financial landscape, goes beyond simple Old Age Home Monthly Cost in Kolkata estimates. We will deep-dive into budgeting, investment strategies, government schemes, and the essential legal framework needed to protect your assets and peace of mind. Proper planning today guarantees that you or your loved ones receive the Best Senior Citizen Homes in Kolkata without financial strain.

II. Deciphering the Cost Structure of Senior Living (Approx. 200 words)

Understanding the true financial commitment is the first step in effective financial planning for senior living in Kolkata.

2.1 The Two Major Fee Components

Admission/Security Deposit (Initial Outlay): This is a one-time, often refundable fee. Factor this initial capital requirement into your Financial Checklist Before Moving to a Senior Home.

Monthly Maintenance Charges for Retirement Homes: This covers food, utilities, standard healthcare, and common area upkeep. This is where you will evaluate the Cost of Assisted Living in Kolkata (2025) versus independent living.

2.2 Unmasking Hidden Charges

Be aware of costs not included in the standard fee:

Escalation Rate: How much does the monthly fee increase annually?

Medical Expenses: Does the fee cover specialized care like Palliative Care or geriatric consultations? Check for separate charges for 24×7 Nursing and Attendant Services.

Exit Clauses: Are there penalties or delays in refunding the deposit if the resident leaves prematurely?

III. Investment and Income Strategies for Funding Care (Approx. 250 words)

How do you generate the steady income needed to cover continuous monthly maintenance charges? Diversified planning is key.

3.1 Leveraging Retirement Income

Maximize your existing guaranteed income sources:

Pension Planning for Retirement Home Fees: Ensure your pensions (both government and private) are streamlined and disbursed directly.

Senior Citizen Savings Scheme (SCSS) for Care Payment: The assured interest rate on SCSS makes it an excellent, low-risk source of stable, regular income to cover monthly fees.

3.2 Smart Asset Utilization

Exploring property and asset-based solutions:

Reverse Mortgage for Senior Living Funding: This allows seniors to convert their home equity into regular payments without selling the property, providing a critical income stream for care payments.

Investment Options for Senior Living: Look at Monthly Income Plans (MIPs) or high-yield Fixed Deposits that ensure liquidity and predictable returns to supplement your cash flow.

Crucial Question: Is it cheaper to live in an old age home or at home in Kolkata? Often, the cumulative cost of in-home specialized care can exceed that of a well-equipped senior living facility.

IV. Navigating Government Schemes and Financial Support

The Government of India and West Bengal offer schemes that can significantly ease the financial burden.

Financial Support for Senior Citizens India: Be aware of Central Government schemes aimed at reducing healthcare costs.

National Programme for Healthcare of Elderly (NPHCE) Benefits: Understand how this programme can reduce out-of-pocket medical expenditure, freeing up funds for living costs.

Government Subsidy for Old Age Homes in West Bengal: While direct subsidies for luxury homes are rare, look for state-sponsored assistance or tax benefits related to elder care that may apply to your situation.

- Tax Benefits and Deductions: Take advantage of high tax deductions available under Section 80D for health insurance premiums paid for senior citizens. Consult a financial advisor to ensure you are utilizing every possible deduction related to the maintenance and medical care of senior family members.

V. The Critical Legal and Estate Planning Framework

Financial planning is incomplete without securing the legal aspects of your future and assets. This section is vital for comprehensive security.

5.1 Protecting Your Assets and Decisions

Making a Will in Kolkata for Senior Citizens: Ensure your Will is updated, clear, and legally sound to prevent family disputes later on. This is the cornerstone of Estate Planning for Senior Citizens in Kolkata.

Power of Attorney for Elderly Care Decisions: Appoint a trusted person (financial POA and healthcare POA) who can legally manage your finances and healthcare choices if you become incapable. This ensures continuity in payment of the Monthly Maintenance Charges.

Legal Aid for Senior Citizens Regarding Property: Be aware of laws protecting seniors from property exploitation, especially if liquidating assets to fund the move.

5.2 The Role of Long-Term Care Insurance

Long-Term Care Insurance India: While still a growing market, look into policies that specifically cover costs associated with Assisted Living, nursing care, and chronic illness management, potentially reducing the reliance on personal savings.

VI. Conclusion: Your 2025 Financial Checklist

Successful Financial Planning for Senior Living in Kolkata (2025) is not about wealth; it’s about preparedness. By proactively addressing the costs, leveraging suitable investments, and setting the legal framework, you secure a dignified retirement.

Your next steps should include:

Cost Comparison: Get quotes and understand the complete fee structure, including the Old Age Home Admission Fees and Hidden Charges.

Legal Review: Finalize your Will and Power of Attorney with a legal expert in Kolkata.

Income Assessment: Confirm that your SCSS and pension income adequately cover the recurring monthly maintenance charges.

M.A.(Hons) in Geography at University of Calcutta.

writing-specific social work courses such as interviewing and documentation,

professional seminars, and writing modules in all BSW and MSW