Retirement Expense Planning: A 10-Year Blueprint for Financial Confidence

Retirement represents one of life’s most significant transitions—a shift from earning an income to living on carefully accumulated resources. Effective retirement expense planning isn’t just about having enough money; it’s about strategically aligning your savings with your future lifestyle for a decade or more. As we approach 2026, the financial landscape continues to evolve, making proactive planning more critical than ever. This comprehensive guide will walk you through creating a sustainable 10-year budget that addresses both expected costs and unforeseen challenges, ensuring your golden years are truly golden.

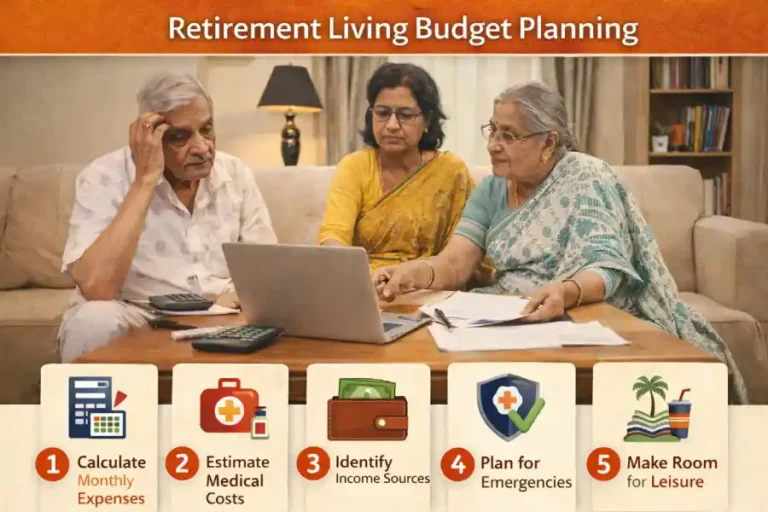

“A critical part of retirement living budget planning is forecasting your future housing costs. While many prefer to ‘age in place,’ it’s prudent to research the costs of alternative living arrangements. For some, a well-managed senior living community can offer predictable costs and built-in support. If Kolkata is your chosen retirement base, understanding the landscape of old age homes in Kolkata—from assisted living to full-care facilities—is essential for a complete financial picture. You can compare services and costs of reputable old age homes in Kolkata to include a potential range in your long-term budget.”

Why a 10-Year Horizon Matters in Retirement Expense Planning

Traditional retirement planning often looks at the big picture, but a decade-focused approach provides actionable clarity. A 10-year timeframe allows you to:

Phase your spending: Recognize that early retirement years often involve more travel and activity.

Anticipate healthcare shifts: Prepare for increasing medical needs.

Adjust for inflation: Build realistic projections for rising costs.

Manage portfolio withdrawals: Implement sustainable distribution strategies.

Your retirement expense planning should begin at least 5 years before you retire, but it’s never too late to create or refine your plan.

The 7 Pillars of Effective Retirement Expense Planning

1. Categorize Your Expenses: The Foundation

Begin by dividing your future costs into essential buckets:

Non-Negotiable Essentials: Housing (mortgage/rent, taxes, maintenance), utilities, groceries, insurance premiums, and basic transportation.

Healthcare Costs: Premiums for Medicare Parts B & D, supplemental insurance, out-of-pocket expenses, dental, vision, and potential long-term care.

Lifestyle & Discretionary: Travel, hobbies, dining out, gifts, and entertainment.

Contingencies: Emergency fund for unexpected repairs, family needs, or economic downturns.

LSI Keywords: retirement budgeting, post-retirement costs, senior living expenses, pension planning, fixed vs variable expenses.

2. Project Healthcare Costs Realistically

Healthcare often becomes the most volatile and significant expense. For robust retirement expense planning, consider:

The average retiree spends $6,500-$7,500 annually on out-of-pocket medical costs (excluding long-term care).

Medicare covers only about 80% of eligible expenses.

Plan for periodic increases in premiums and prescription costs.

Explore Health Savings Accounts (HSAs) if you’re still working—they offer triple tax advantages.

3. Housing: To Stay or To Downsize?

Your housing decision dramatically impacts your 10-year budget. Evaluate:

Aging in Place: Modifications for accessibility (ramps, bathroom grips) and maintenance costs.

Downsizing: Potential equity release but consider transaction costs and emotional impact.

Senior Communities: Weigh all-inclusive costs against benefits.

4. Inflation: The Silent Budget Eroder

At a 3% annual inflation rate, expenses double every 24 years. Your retirement expense planning must incorporate:

Historical Averages: Healthcare inflation typically outpaces general inflation.

COLA Adjustments: If you have pension or Social Security with cost-of-living adjustments.

Investment Strategy: Allocate a portion of your portfolio to inflation-protected securities (like TIPS) or growth assets.

5. Tax-Efficient Withdrawal Strategies

The order in which you tap accounts matters:

Taxable Accounts: Utilize capital gains rates.

Tax-Deferred Accounts (401k, Traditional IRA): Required Minimum Distributions (RMDs) begin at age 75 (under current law).

Tax-Free Accounts (Roth IRA): Withdraw contributions anytime tax-free; let earnings grow longest.

LSI Keywords: RMD strategy, tax-efficient retirement, withdrawal rate, sequence of returns risk, sustainable income.

6. Plan for the “Go-Go, Slow-Go, No-Go” Phases

Retirement isn’t monolithic. Your retirement expense planning should reflect three distinct phases:

Years 1-4 (Go-Go): Higher discretionary spending on travel and new activities.

Years 5-8 (Slow-Go): Spending stabilizes, focus shifts to local hobbies and family.

Years 9-10+ (No-Go): Healthcare costs may rise, while discretionary spending decreases.

7. Build a Contingency Cushion

Aim for 1-2 years of essential expenses in liquid accounts (cash, money market). This buffer protects you from selling investments during market downturns—a key risk in early retirement.

Implementing Your 10-Year Retirement Expense Plan: A Step-by-Step Approach

Year 0 (Pre-Retirement):

Track current spending meticulously for 3-6 months.

Create a mock retirement budget and try living on it.

Pay off high-interest debt.

Maximize retirement account contributions.

Years 1-3 of Retirement:

Start with a conservative withdrawal rate (traditionally 4%, but consider 3-3.5% in current economic climates).

Review spending quarterly; adjust as you discover actual costs.

Establish your healthcare framework (Medicare sign-up at 65 is critical).

Years 4-7:

Reassess housing suitability.

Update estate documents (will, trust, powers of attorney).

Consider part-time work or consulting if desired for engagement and supplemental income.

Years 8-10:

Re-evaluate long-term care needs and insurance.

Simplify investments for easier management.

Confirm beneficiaries and legacy intentions.

Common Retirement Expense Planning Pitfalls to Avoid

Underestimating Longevity: Plan for at least 30 years in retirement if retiring at 65.

Overlooking Spousal Needs: The surviving spouse often faces reduced income but similar fixed costs.

Ignoring Cognitive Decline: Automate bills and create a trusted contact system with financial institutions.

Failing to Update Plans: Review and adjust your retirement expense planning annually.

The Role of Professional Guidance

While this guide provides a framework, consider consulting a fee-only fiduciary financial planner specializing in retirement. They offer personalized strategies considering tax laws, investment nuances, and your unique circumstances—enhancing the E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) of your plan. Look for credentials like CFP® (Certified Financial Planner) or RMA® (Retirement Management Advisor).

Conclusion: Your Path to a Confident Retirement

Retirement expense planning is not a one-time task but an ongoing process of alignment between your finances and your life vision. By breaking down the next decade into manageable phases, anticipating key transitions, and building flexibility for the unexpected, you create more than a budget—you create peace of mind. Begin today, revisit regularly, and remember: the goal isn’t merely to manage expenses, but to fund a meaningful and secure retirement chapter.

Your journey toward confident retirement living starts with a single step: honest assessment followed by intentional action. The next ten years await your thoughtful planning.

Frequently Asked Questions (FAQ)

Q1: What is the most overlooked expense in retirement planning?

A: Many retirees underestimate healthcare costs beyond Medicare premiums, particularly dental, vision, hearing aids, and long-term care. These out-of-pocket expenses can significantly impact a 10-year budget if not planned for proactively.

Q2: How much should I budget for discretionary spending in early retirement?

A: A common guideline is to allocate 20-30% of your total retirement budget to discretionary spending (travel, hobbies, dining) in the first 3-5 active years. This typically moderates in later years as lifestyle preferences shift.

Q3: Should I pay off my mortgage before retiring?

A: It depends on your cash flow and interest rate. Eliminating a mortgage reduces fixed expenses and provides psychological security. However, if you have a very low fixed rate, investing excess funds might yield higher returns. Run the numbers with your entire financial picture.

Q4: How often should I review my retirement expense plan?

A: Conduct a formal review at least annually. However, monitor your budget vs. actual spending quarterly. Trigger a mid-year review for any major life changes: health events, market shifts of ±15%, or family circumstances.

Q5: Is the 4% withdrawal rule still valid for 2026 retirees?

A: The 4% rule (withdrawing 4% of your portfolio initially, adjusted for inflation) is a starting point but not a guarantee. Given longer lifespans and market volatility, many advisors now suggest a 3-3.5% initial withdrawal rate, with flexibility to adjust based on market performance.

M.A.(Hons) in Geography at University of Calcutta.

writing-specific social work courses such as interviewing and documentation,

professional seminars, and writing modules in all BSW and MSW